Tech making you queasy?

We believe healthcare offers an attractive combination of significant earnings growth potential and a historic valuation discount.

- Peter Hughes

- 3 min reading time

Source: Trustnet

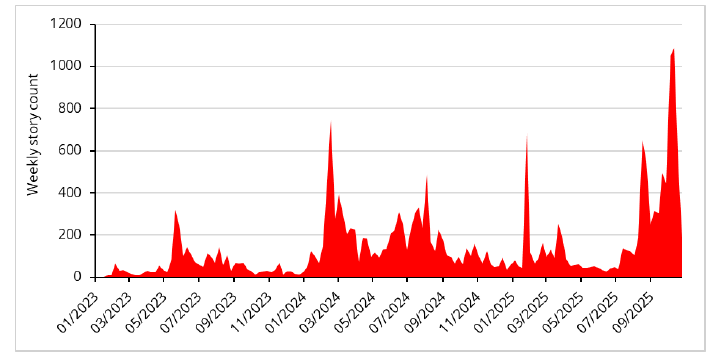

If you pick up a newspaper today, it is likely that you will find an article either proclaiming or disputing the existence of an artificial intelligence (AI) bubble. As the chart below shows, in the week commencing the 17 October, 1,100 articles globally included the term ‘AI bubble’.

Articles mentioning ‘AI bubble’

Source: Bloomberg, 31 October 2025. The information shown above is for illustrative purposes.

The dizzying valuations and speculative corporate investments in AI are enough to make anyone feel queasy. OpenAI recently committed to spend more than $1trn over a five-year period, around 100x its annual recurring revenue.

Investors therefore, find themselves in a dilemma. While many may still have a pervasive fear of missing out, an increasing number are concerned about investing in a bubble that could pop at any moment and are looking for more attractively priced opportunities.

Healthcare offers the potential for tech-like growth at a far more reasonable price

We believe healthcare offers an attractive combination of significant earnings growth potential and a historic valuation discount.

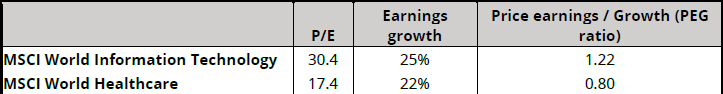

The technology sector is forecast to grow earnings at a 25% compound annual growth rate (CAGR) through to 2027. It may surprise many to realise that healthcare earnings are not far behind with a forecast 22% CAGR over the same period.

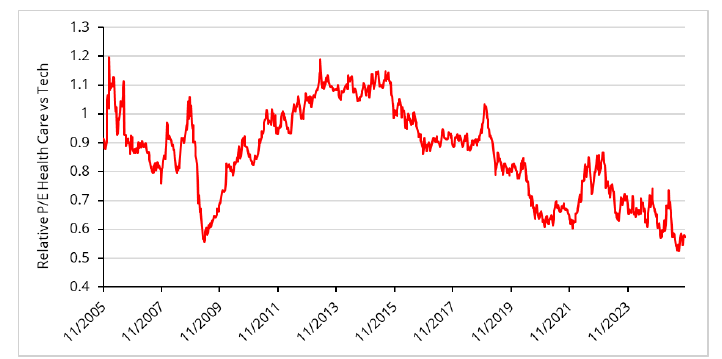

And yet, despite the similar earnings outlook, the healthcare sector hasn’t traded at such a deep discount to technology stocks since the financial crisis.

Relative P/E - healthcare vs tech indices

Source: Bloomberg, 31 October 2025. Past performance is not a guide to the future. The information shown above is for illustrative purposes.

At prevailing prices, the growth potential offered by the tech sector is 50% more expensive than health care – something a price earnings growth (PEG) ratio can tell you.

Price earnings growth ratio –tech and healthcare indices

Source: Bloomberg, 31 October 2025. The information shown above is for illustrative purposes.

Reasons for the valuation gap appear to be receding

As we noted in July this year and in our more recent discussion of the Not-So-Magnificent-17, a number of factors drove the emergence of the healthcare sector’s discount, many of which we believe are now moderating.

In particular, the risk of changes to US drug pricing policy was at the forefront of many investors’ minds earlier this year. More recently, a number of pharma companies have made deals with the US administration, potentially taking aggressive drug price reductions off the table while both sides can claim victory.

At the same time, the FDA continues to approve new therapies at pace, with 35 new drugs approved this year to date. This is roughly in line with the 38 drugs approved at the same point in 2024, showing innovation in the sector remains vibrant.

Although these updates are specific only to pharma, the increased clarity has had a positive effect on supply chains too. Some tools companies, which provide the technology and services to help bring therapies to market, are seeing a marked increase in activity from their biopharma customers.

We believe this could be a leading indicator for upgraded earnings outlooks for that sub-sector.

Peter Hughes is portfolio manager of Redwheel’s Life Changing Treatments Strategy. The views expressed above should not be taken as investment advice.

Important legal information

Lloyds and Lloyds Bank are trading names of Halifax Share Dealing Limited. The Lloyds Bank Direct Investments Service is operated by Halifax Share Dealing Limited. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Registered in England and Wales no. 3195646. Halifax Share Dealing Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2025 Refinitiv, an LSEG business. All rights reserved.