The area you should be using for income – but probably aren’t

Many look to the FTSE 100 for income, but there could be an even better option.

- Jonathan Jones

- 3 min reading time

Source: Trustnet

Investing for income can be a priority for many investors, whether it be to supplement a salary, earn a living entirely or to keep comfortable in retirement.

The UK is perhaps the market most synonymous with income, thanks to its higher-than-average dividends and yield. Unlike countries such as the US – where companies focus more on growth and reinvesting their spare cash – UK stocks have long history of returning excess money to shareholders.

Many will look at the FTSE 100 as the best place for this, with big payers such as the oil giants, miners and banks all residing at the top of the domestic market.

Yet those that rely on these mega companies are putting their eggs into an increasingly small basket. More than half (57%) of all dividends in the index are paid by just 10 companies, with the remaining 43% coming from the other 90 names, according to data this week from Octopus Investments’ ‘Dividend Barometer’.

What’s more, the traditional income sectors might not be the best areas of the market to invest in going forward from a total return perspective.

Investors can get much more diversification further down the market. On average, the 10 largest dividend-paying companies in the FTSE 250 accounted for just 22% of the total paid out by constituents of the mid-cap index, Octopus found. This rose slightly to around a third of FTSE Small Cap companies and 36% of the amount from those quoted on AIM.

But this is not the only reason why mid- and small-caps might be a better option for income seekers than their larger counterparts.

Among the four indices mentioned, companies in the FTSE 100 have the lowest dividend cover, a measure of a stock’s earnings relative to the amount of money paid out to shareholders each year.

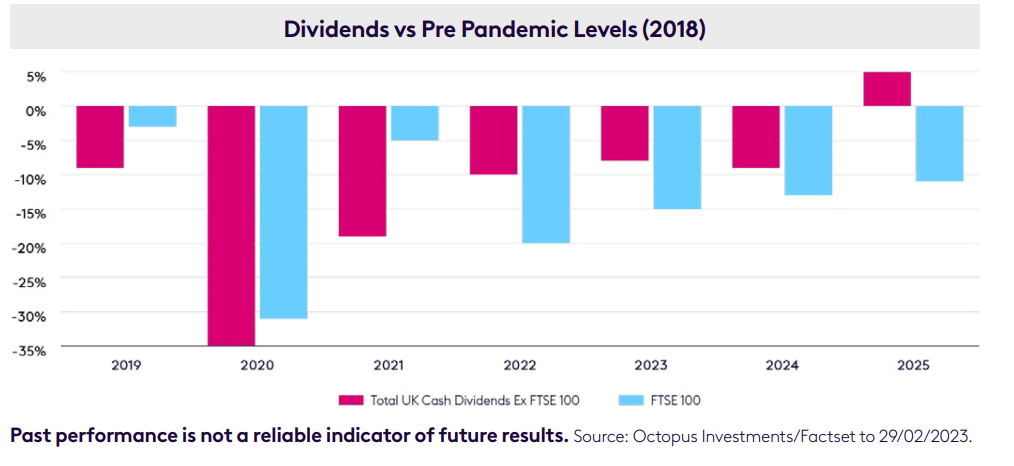

Additionally, while investing as a whole took a big hit during the pandemic in 2020 as companies held back cash to cover shortfalls, the lower parts of the market have been quicker to recover. While FTSE 100 dividends are still some way from their pre-pandemic levels, companies outside of large-cap status are much closer.

And this is set to continue. Octopus forecast FTSE 100 dividends to remain 11% behind 2018 levels by the end of 2025, while the rest of the market will overtake previous highs by the end of next year.

Of course, mid-caps are not going to be right for everyone. Smaller stocks tend to be inherently riskier and therefore may not suit retirees, for example.

But even this is a double-edged sword as they also have the potential for higher gains as they have more room to grow. And this is a crucial part of income investing that many forget.

Buying stocks where the share price should in theory rise more quickly (as is the case with mid- and small-caps) creates a double-whammy for investors.

Now this is by no means a reason to sell all of your large-caps and move lower down the market, but if you do need income, it is worth considering putting a sleeve of your portfolio into stocks further down the cap spectrum.

Important legal information

The Lloyds Bank Direct Investments Service is operated by Halifax Share Dealing Limited. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Registered in England and Wales no. 3195646. Halifax Share Dealing Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2024 Refinitiv, an LSEG business. All rights reserved.