Columbia Threadneedle and Aviva to shutter UK smaller companies funds

The two longstanding funds will close later this year.

- Jonathan Jones

- 2 min reading time

Source: Trustnet

The £153.7m CT UK Smaller Companies fund and £28m Aviva Investors UK Smaller Companies fund are both to be closed in the coming months, according to regulatory filings. The former will close its doors on 6 June while the latter is to shut on 10 May.

UK small-caps have had a torrid time of late, with investors moving away from riskier assets in favour of defensive holdings such as bonds and cash, which now offer attractive returns thanks to higher interest rates.

This, along with economic uncertainty surrounding inflation and geopolitical tensions around the world, has caused investors to take a more cautious approach.

While some believe better times are ahead, Columbia Threadneedle and Aviva have thrown in the towel on their funds.

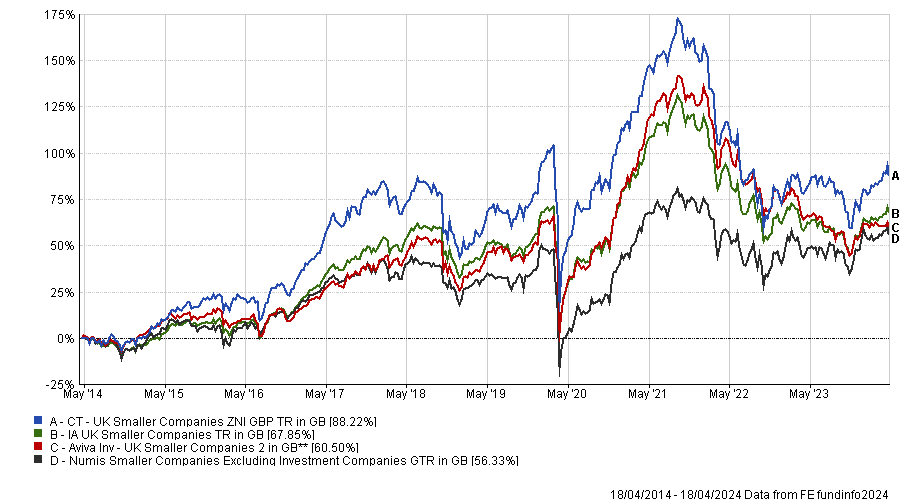

CT UK Smaller Companies, managed by James Thorne since 2010, was originally launched in February 1995 and has been one of the best performers in the IA UK All Companies sector over the past decade, making 88.2%.

However, more recent performance has underwhelmed, with the fund down 23.3% over three years. The fund’s assets under management (AUM) have dropped significantly in recent years from £295m in May 2021 to the £153.7m today.

Conversely, the Aviva Investors UK Smaller Companies fund has struggled over the long term, with a return of 60.5% over 10 years and has fared even worse over three years, down 25.4%.

Trevor Green has managed the fund since 2014 and was joined by co-manager Charlotte Meyrick in 2017. The fund pre-dates both however, having been initially launched in 1998. Assets under management reached £66m in July 2021 but have slipped back to the £28m in the fund at present.

Performance of funds vs sector and benchmark over 10yrs

Source: FE Analytics

A spokesperson for Aviva Investors said: “To ensure our fund range remains efficient, of high quality and provides the best outcomes for our clients, we regularly assess the value offered by our funds. This assessment process has led us to take the decision that it is in the best interests of investors to close the fund.

“The fund possessed a relatively small AUM and as such we would expect the broader impact of this decision to be very limited. The announcement has already been communicated to clients.”

Investors will have the option to switch into another Aviva Investors fund free of charge or to receive the proceeds of the sale of their investment as cash.

Columbia Threadneedle has been approached for comment.

Important legal information

The Lloyds Bank Direct Investments Service is operated by Halifax Share Dealing Limited. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Registered in England and Wales no. 3195646. Halifax Share Dealing Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2024 Refinitiv, an LSEG business. All rights reserved.