Bonds will outperform equities over the long term, says top multi-asset manager

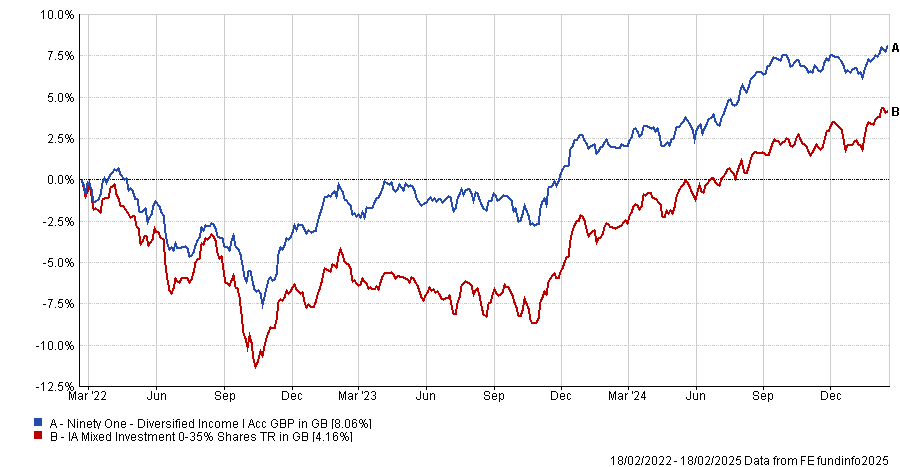

Ninety One’s Jason Borbora-Sheen explains why fixed income has greater long-term potential than equities.

- Patrick Sanders

- 4 min reading time

Source: Trustnet

Bonds are usually seen as a haven asset, offering lower potential returns but without the risk when compared with equities. However, Jason Borbora-Sheen, co-manager of the £747m Ninety-One Diversified Income fund, said this could be on the verge of reversing.

Traditionally, investors have used a 60/40 portfolio, with more in equities and less in bonds, but this may “soon look more like 50/50 or even 40/60 in favour of bonds”.

He argued this is because equity valuations have become increasingly stretched while bond yields have become far more attractive. For investors with a long-term time horizon, this means bonds – not equities – could become the driving force of investors’ portfolios, matching or even beating the returns of equities.

Valuations are the key to understanding why bonds will surpass equities over the long term. “If you have a very long-time horizon, the thing that will always work for you is valuations”, he said.

Borbora-Sheen explained the price-to-earnings (P/E) ratios of equity markets such as the UK and US are within the 90th to 95th percentile compared to historical averages. By most metrics, they are now quite expensive.

While he conceded an equity investor could still strong returns from their equity investments from here, “structurally equities are facing a valuation headwind”.

If P/E ratios revert (return to the industry average), returns will be more muted and long-term investors will get the “same level of returns from bonds as broad equity markets”.

One area he was particularly keen on was gilts, which he said should outperform over the long term. Investors buying gilts now will “almost certainly” have their 4.5% investment compounded to maturity, making them a dependable way of gaining income and an appealing basis of an investor's portfolio, he said.

This changing dynamic between bonds and equities should also cause investors to rethink their approach to other assets. In a bond-led portfolio, he said alternatives were an underappreciated diversifier.

This may surprise some investors, since alternatives were recently removed from AJ Bell and St James Place's model portfolios, arguing they do not provide sufficient diversification due to high fixed income yields. However, for Borbora-Sheen, the idea alternatives are irrelevant because of high bond yields misunderstands the relationship between bonds and other asset classes.

Even investors with shorter time horizons cannot just buy bonds and forget about them, he argued. As fixed income and equities have become more closely correlated, demonstrated by the fact they both slid in performance when interest rates were high in 2022, drawdowns in bonds would always be a risk.

“A yield of 4% feels much higher than a yield of 2%, but when you consider gilt yields have ranged from zero to 15%, historically, it is not all that much. High yields are not magical numbers that can protect you from losing capital”.

This does not mean bonds cannot be the engine of investors’ portfolios it means investors need to rethink how they diversify their portfolios. This is where alternatives can play a role.

For example, in the Diversified Income fund, he owned New Zealand and Australian bonds, which are very different types of assets and not closely correlated to equities or the UK fixed income market.

The other example he identified was infrastructure, which is still a cautious holding within the portfolio despite recent performance and a significant derating following the pandemic.

Performance of the fund vs the sector over the past 3yrs

Source: FE Analytics

He conceded investors have become disappointed with the poor performance of these infrastructure names since the pandemic and questioned if they were still worth owning given currently high gilt yields.

“The answer is capital appreciation”, he said. You can make money in these and other alternatives, build a decent income while you wait, and inject much-needed diversification into your portfolio,” said Borbora-Sheen.

“My argument against the idea you do not need alternatives is that if you are trying to produce good risk-adjusted returns, you absolutely do need alternatives”.

Important legal information

Lloyds and Lloyds Bank are trading names of Halifax Share Dealing Limited. The Lloyds Bank Direct Investments Service is operated by Halifax Share Dealing Limited. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Registered in England and Wales no. 3195646. Halifax Share Dealing Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2025 Refinitiv, an LSEG business. All rights reserved.