Investors poured into US equities in March, ahead of Wall Street chaos

The latest Calastone Fund Flow index reveals US equities remained popular in March despite volatility.

- Patrick Sanders

- 2 min reading time

Source: Trustnet

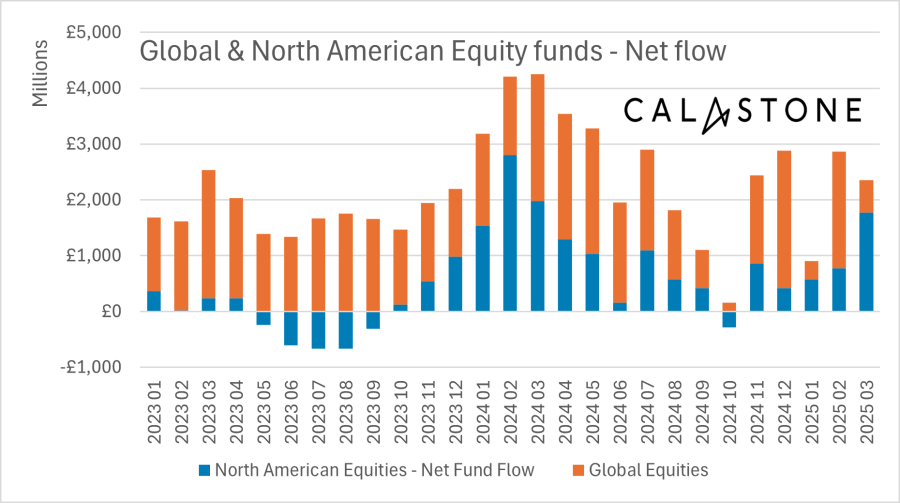

In March, equity funds experienced their best month of inflows in 2025 so far, according to the latest data from Calastone, with North American equity funds experiencing their highest inflows since March 2024.

North American funds absorbed a net £1.77bn last month, led by index trackers that attracted £8 of every £10 invested. Global funds, which are still dominated by US equities, followed with net inflows of £580m.

Source: Calastone Fund Flow Index – Mar 2025

Investor appetite remained undimmed by the US equity market selling off since mid-February. Nonetheless, Calastone’s March data does not reflect any trading activity after global equity markets went into meltdown following Donald Trump’s ‘Liberation Day’ tariffs on 2 April.

Edward Glyn, head of global markets at Calastone, said: “The strong appetite for US equities in March is at odds with tidal forces in global markets that are seeing a strong rotation out of US assets and into markets like Europe and the UK.”

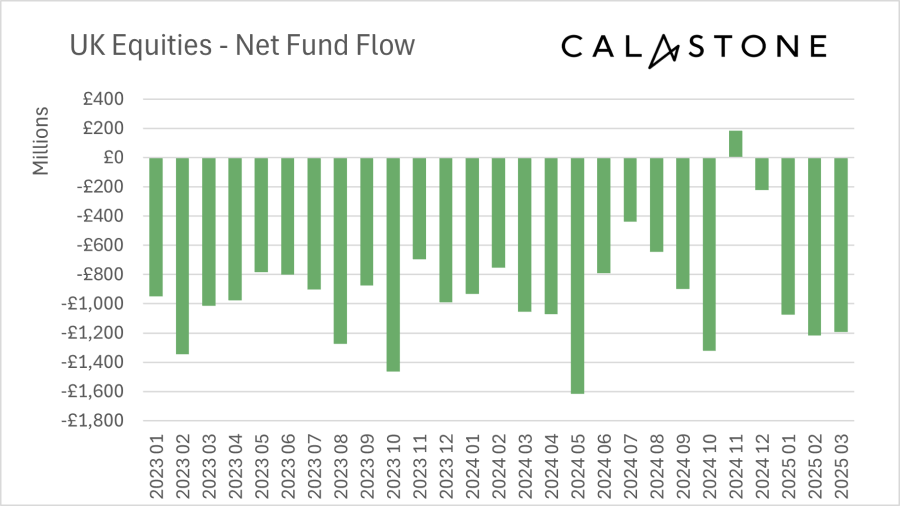

Only Asia Pacific and UK funds experienced outflows last month. UK funds had a particularly poor month, with investors pulling £1.19bn in March, bringing the year's total outflows to £3.48bn, the worst quarter on record.

This comes despite a relatively strong UK stock market, which outperformed global equities during the first quarter.

Source: Calastone Fund Flow Index – Mar 2025

“Bond flows perhaps tell us more about underlying investor sentiment at present,” Glyn said.

Indeed, as inflation fears rose, investors sold a net £700m of their bond fund holdings last month, the worst result since September 2024. By contrast, money market funds surged, absorbing an extra £513m, meaning money market funds had their best quarter on record.

Glyn concluded: “Headlines dominated by talk of trade wars, economic uncertainty and inflation have seemingly put bond investors off the asset class for the time being. Strong flows into safe-haven money market funds suggest uncertainty is a key motivator.”

Important legal information

Lloyds and Lloyds Bank are trading names of Halifax Share Dealing Limited. The Lloyds Bank Direct Investments Service is operated by Halifax Share Dealing Limited. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Registered in England and Wales no. 3195646. Halifax Share Dealing Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2025 Refinitiv, an LSEG business. All rights reserved.