Invesco gives three of its funds a red flag

Invesco admitted that three of its funds, investing in Japanese, UK and European equities, have not delivered value to investors.

- Patrick Sanders

- 2 min reading time

Source: Trustnet

Invesco’s latest assessment of value report flagged three funds for failing to deliver value: the Invesco Japanese Equity Advantage (UK) fund, the Invesco UK Companies fund and the Invesco European Equity Income (UK) fund.

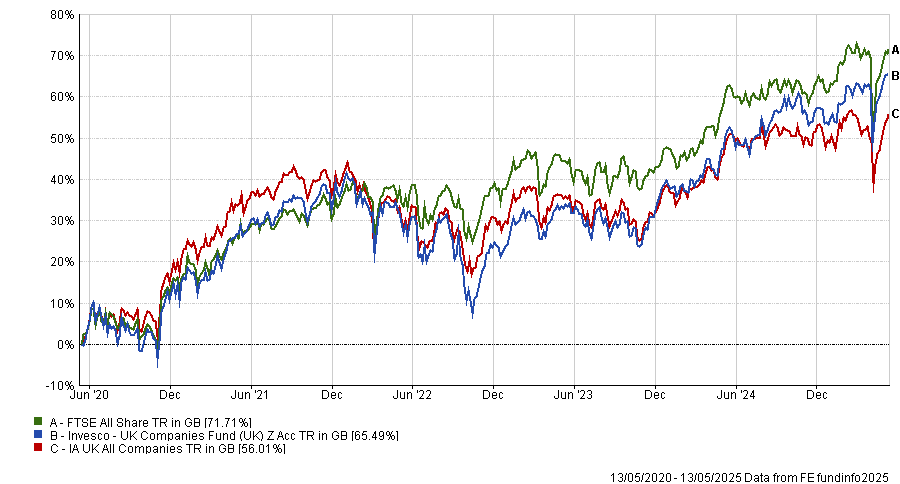

Martin Walker’s £130m Invesco UK Companies fund has delivered a 65.5% return over five years but failed to beat the FTSE All Share.

Performance of the fund vs sector and benchmark over past 5yrs

Source: FE Analytics

Invesco said the fund’s manager and investment process were changed in September last year and argued that fund is better positioned to deliver value in the future.

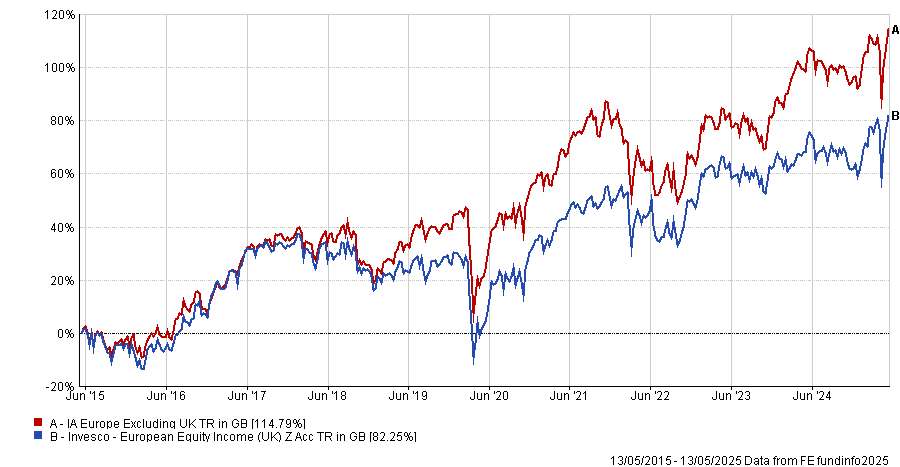

The £452m Invesco European Equity Income fund was also flagged for failing to beat its benchmark, the IA Europe Excluding UK sector, over the past one, three and 10 years.

Performance of fund vs sector and benchmark over the past 10 yrs

Source: FE Analytics

The assessment of value report added: “The team has taken action to address performance challenges and will need time to assess whether the changes made are resulting in better performance outcomes.”

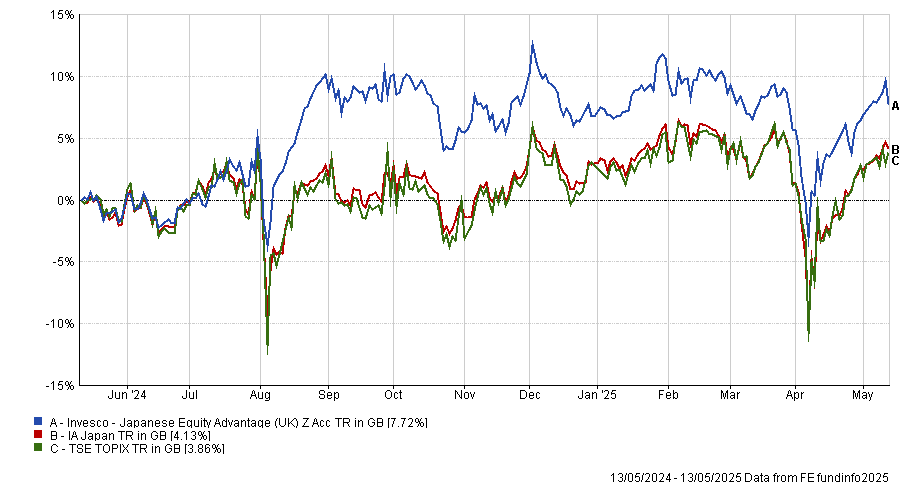

Finally, the £94m Invesco Japanese Equity Advantage (UK) also underperformed over the past three, five and 10 years, ranking within the third or bottom quartile of its peer group. Over 10 years it is the worst performing fund in the sector, up by just 49.9% compared to a sector average of 100.6%.

However, recent performance is better, with the fund up 7.7% over the past year, outperforming the sector average and benchmark.

Performance of fund vs sector and benchmark over one year

Source: FE Analytics

This improvement was attributed to changes made last year, when FE fundinfo Alpha Manager Tadao Minaguchi took over from the previous manager and the fund’s emphasis on environmental, social and governance (ESG) criteria was removed. Invesco conceded that it “needs time to assess if the changes made are resulting in better performance” but concluded that no further action is currently required.

Important legal information

Lloyds and Lloyds Bank are trading names of Halifax Share Dealing Limited. The Lloyds Bank Direct Investments Service is operated by Halifax Share Dealing Limited. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Registered in England and Wales no. 3195646. Halifax Share Dealing Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2025 Refinitiv, an LSEG business. All rights reserved.