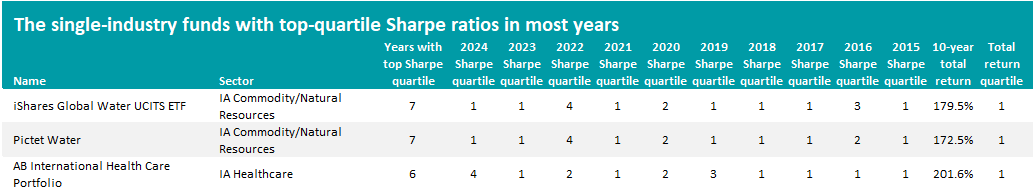

The single-sector funds with the highest Sharpe ratios year in, year out

Trustnet looks for single-industry funds with high Sharpe ratios in most years of the past decade.

- Gary Jackson

- 4 min reading time

Source: Trustnet

Just three funds in the single-industry sectors have been able to consistently deliver the highest Sharpe ratios of their peer group, Trustnet research has found.

The Sharpe ratio assesses an investment’s risk-adjusted return by comparing its excess return above the risk-free rate to the investment’s standard deviation. A higher ratio suggests greater return for each unit of risk, making it a valuable measure for judging how efficiently a fund delivers performance.

In this series, Trustnet examines the Sharpe ratios of funds over the past 10 years to identify those that have ranked in their sector’s top quartile for at least six of those years based on this widely used risk-return indicator.

Here, we look at the various industry-specific sectors in the Investment Association universe: IA Commodity/Natural Resources, IA Financials and Financial Innovation, IA Healthcare, IA Infrastructure and IA Technology & Technology Innovation.

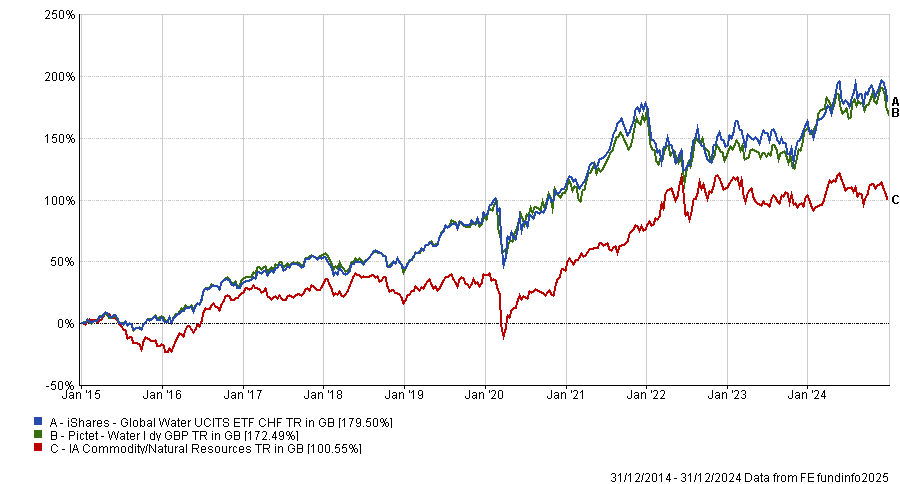

Source: FE Analytics. Total return in sterling between 1 Jan 2015 and 31 Dec 2024

Only three funds have managed to achieve this and they can be seen in the table above, along with their quartiles for Sharpe ratio in each year and the total return over 10 years to the end of 2024.

Two funds reside in the IA Commodity/Natural Resources sector: iShares Global Water UCITS ETF and Pictet Water. Both have been the peer group’s first quartile for Sharpe ratio in seven of the past 10 years but iShares Global Water UCITS ETF has made a slightly higher return over the period.

The water investment theme centres on companies that deliver essential services and technologies for water supply, treatment and infrastructure. This includes utilities, engineering firms, filtration providers and technology specialists focused on improving water efficiency.

Some investors are drawn to the theme because water is a fundamental need with steady demand, regardless of economic conditions. Companies in this sector often benefit from stable cashflows and long-term regulatory frameworks.

Others view the theme as a way to access infrastructure and industrial innovation without the high volatility of more cyclical sectors. Many water-focused businesses operate in regulated environments or offer specialised solutions backed by long-term contracts, which can support earnings stability.

The iShares Global Water UCITS ETF tracks the S&P Global Water index, meaning it has close to 90% of its portfolio in industrials and utilities companies. Top holdings include Xylem, American Water Works and Severn Trent.

Pictet Water is actively managed, run by Cédric Lecamp, Louis Veilleux, Charlie Carnegie and Ola Obanubi. It has 51% of its portfolio in water technology companies, 28% in environmental services and 20% in water supply.

Performance of iShares Global Water and Pictet Water vs sector between 1 Jan 2015 and 31 Dec 2024

Source: FE Analytics. Total return in sterling between 1 Jan 2015 and 31 Dec 2024

The only other fund to make it into this study’s shortlist is AB International Health Care Portfolio, which resides in the IA Healthcare sector. As well as being in the sector’s top quartile for Sharpe ratio in six of the past 10 years, it made a 201.6% total return over that decade.

Managed by Vinay Thapar and John H. Fogarty (who both hold FE fundinfo Alpha Manager status), the fund’s approach is based around “investing in business, not science”. This means the managers focus on healthcare stocks that can generate profits and drive cost savings, rather than attempting to predict scientific breakthroughs.

Thapar and Fogarty want high-quality businesses, seeking out those with capital efficiency and strong reinvestment rates. They also balance portfolio risk around multiple companies, instead of hoping strong performance comes from a handful of stocks.

While only these three single-industry funds have been in the top quartile for Sharpe ratio in six or more years, our research found another three achieved this in five years: Polar Capital Global Insurance, Polar Capital Healthcare Blue Chip and abrdn Global Infrastructure Equity.

Important legal information

Lloyds and Lloyds Bank are trading names of Halifax Share Dealing Limited. The Lloyds Bank Direct Investments Service is operated by Halifax Share Dealing Limited. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Registered in England and Wales no. 3195646. Halifax Share Dealing Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2025 Refinitiv, an LSEG business. All rights reserved.