Sector focus: European equities surge in 2025

Trustnet finds out how European equities have caught investors’ eyes this year.

- Gary Jackson

- 6 min reading time

Source: Trustnet

Investors have turned positive on European stocks with the opening months of 2025 seeing them outpace US equities, but exactly which of the region’s stocks and funds are performing the best?

The June edition of Bank of America’s closely watched Global Fund Manager Survey found a net 34% of asset allocators are overweight European equities. This is 0.8 standard deviations above the long-term average and reflects vastly improved sentiment towards the once-unloved region.

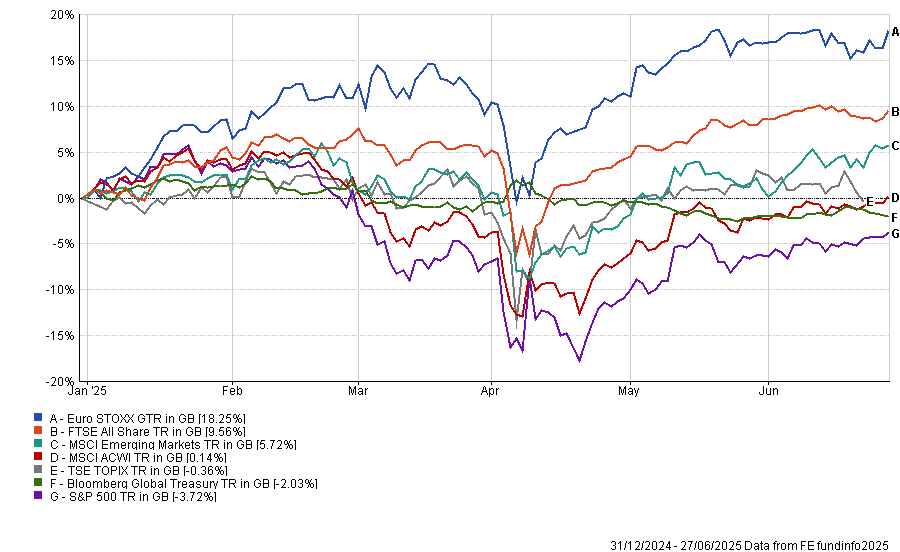

There is no doubt that 2025 is turning out to be a strong year for European equities. Since the start of the year, the Euro STOXX index has made a 18.3% total return (in sterling terms), compared with a 0.6% loss from the MSCI AC World index.

Performance of Euro STOXX vs other equity indices in 2025

Source: FE Analytics. Total return in sterling between 1 Jan and 27 Jun 2025

As the chart above shows, European stocks have outpaced all the major equity regions and government bonds by a wide margin this year. This includes US stocks – the former market darlings – as tariff threats, political uncertainty and high valuations caused investors to rotate away from the US.

Alex Holroyd-Jones, multi asset portfolio manager at Ninety One, also highlighted the positives for Europe: “A confluence of macroeconomic forces is building a more constructive case for European equities. Chief among them is the region’s cyclical upturn.

“The eurozone is showing signs of recovery after weak growth for much of the last two years. Business sentiment, measured by [purchasing managers’ indices], is climbing, led by improvement in manufacturing. Consumer confidence is also recovering, buoyed by real wage growth as inflation cools and employment remains resilient. A new credit cycle has emerged, with credit growth regaining after a period of contraction. Europe’s long-idling growth engine is finally gaining traction.”

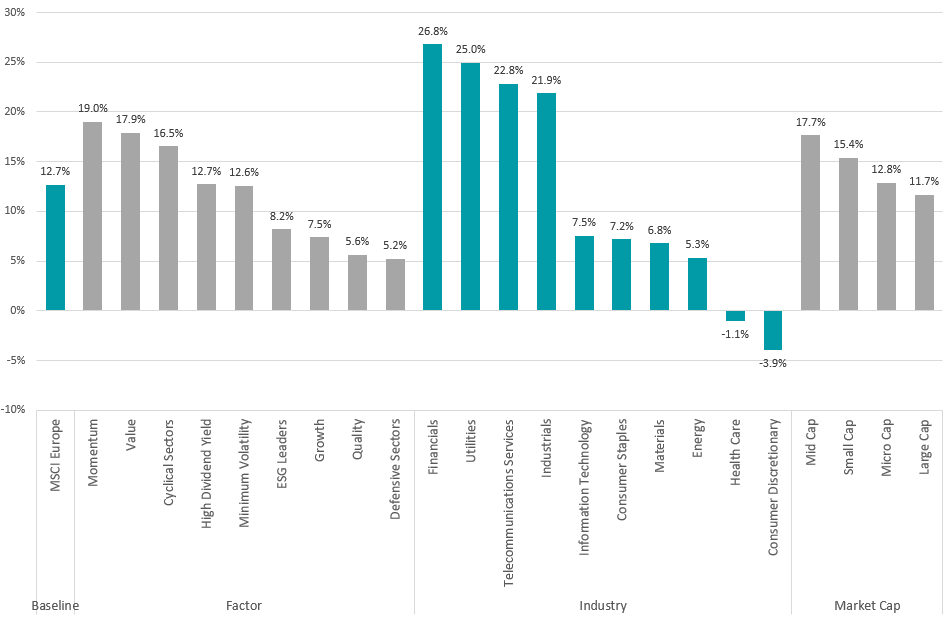

Performance of European equity sub-indices in 2025

Source: FinXL. Total return in sterling between 1 Jan and 27 Jun 2025

While European stocks have had a strong first half of 2025, the gains haven’t been evenly spread. Financials, utilities and telecoms stand out with returns well above the MSCI Europe benchmark.

These sectors are seen as stable and income-generating, especially in an environment where interest rates remain high and economic uncertainty lingers. Investors are leaning into dependable earnings and steady cash flows rather than chasing more speculative growth.

The pattern is clear in factor performance too. Momentum and value stocks are making the highest returns, while growth and quality have fallen behind, showing a clear shift toward cheaper but proven names over expensive future growth potential.

On an individual country level, the strongest returns have come from Spain (up 29.4%), Norway (24.8%), Austria (24.4%), Italy (21.6%) and Ireland (20.2%). Denmark is the only constituent of the MSCI Europe index in negative territory this year, down 9.4%.

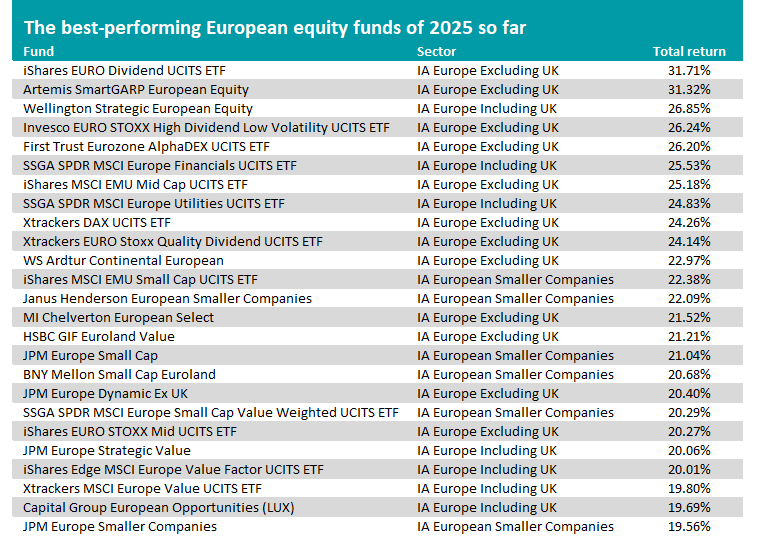

This has acted as a strong backdrop for European equity funds. Of the 250 funds in the IA Europe Excluding UK, IA Europe Including UK and IA European Smaller Companies sectors, 241 - or 96.4% - have made a positive return in 2025 so far. The 25 with the highest returns can be found in the table below.

Source: FE Analytics. Total return in sterling between 1 Jan and 27 Jun 2025

At the top of the table, iShares EURO Dividend UCITS ETF reflects the ‘stable and income-generating’ theme mentioned above. It invests in eurozone companies with the highest dividend yields, with 50.2% of its portfolio in financials, 10.7% in utilities and 5.8% in telecoms.

Invesco EURO STOXX High Dividend Low Volatility UCITS ETF, SSGA SPDR MSCI Europe Financials UCITS ETF, iShares MSCI EMU Mid Cap UCITS ETF and SSGA SPDR MSCI Europe Utilities UCITS ETF also reflect some of the previously highlighted themes.

The £905m Artemis SmartGARP European Equity fund is the highest-ranked active fund in 2025, making a 31.3% total return. Manager Philip Wolstencroft has been running the fund since its launch in 2001 using the SmartGARP process, which seeks out companies growing faster than the market but on lower valuations.

Its biggest sector allocation is to financials (accounting for 41.6% of the portfolio), followed by industrials (11.8%) and healthcare (10.2%). Italy, Spain and France are the largest country weightings.

Analysts at Rayner Spencer Mills Research said: “This fund is suitable as a core investment or for use alongside a large-cap or passive vehicle. The mid-cap weighting is significantly higher than that of the market and introduces investments that are often not found in the fund’s peers. In this way, the fund provides diversification, particularly relative to strategies that are more growth or large-cap orientated.”

Wellington Strategic European Equity is in third place with a 26.8% total return this year. Unlike many of the funds in the table, this resides in the IA Europe Including UK sector, with the UK being its largest geographical allocation.

Manager Dirk Enderlein looks for companies with “superior structural free-cash-flow and earnings growth outlook and a strong competitive positioning combined with attractive valuation levels”. However, the fund is at capacity and currently soft closed to new investments.

Of the 25 best European funds this year, a handful were also in their sectors’ top quartile over the previous three and five years, suggesting their recent strength is not limited to the current market backdrop.

These funds are Artemis SmartGARP European Equity, Wellington Strategic European Equity, SSGA SPDR MSCI Europe Financials UCITS ETF, WS Ardtur Continental European, Janus Henderson European Smaller Companies, BNY Mellon Small Cap Euroland and SSGA SPDR MSCI Europe Small Cap Value Weighted UCITS ETF.

Looking forward, Ninety One’s Holroyd-Jones pointed out that risks remain for European equities, as the continent is reliant on external demand, particularly from China, and therefore vulnerable to US trade policies. It is also a net importer of oil, so further conflict in the Middle East could increase the risk of an oil price shock adding to inflation.

However, he finished: “For investors willing to look beyond short-term noise, Europe offers the potential alignment of improving macro fundamentals, supportive policy, attractive valuations and the prospect of renewed capital inflows away from US assets.

“The eurozone may not displace the US as the epicentre of global equity markets, but its risk assets are well positioned to outperform over the medium term as global capital rebalances.”

Important legal information

Lloyds and Lloyds Bank are trading names of Halifax Share Dealing Limited. The Lloyds Bank Direct Investments Service is operated by Halifax Share Dealing Limited. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Registered in England and Wales no. 3195646. Halifax Share Dealing Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2025 Refinitiv, an LSEG business. All rights reserved.