IBOSS launches new Blended MPS range

The Blended range is “particularly relevant in today’s market” as clients need more than “just passive exposure”.

- Jonathan Jones

- 1 min reading time

Source: Trustnet

Discretionary fund management firm IBOSS has launched a new managed portfolio service (MPS) for clients, with a roughly 50/50 split between its Core MPS and its Passive MPS offering.

Total costs will be 30% lower than its go-anywhere Core range, keeping weightings between the two strategies in a band between 43% and 58% in favour of one or the other.

The new portfolios will be made up of between 40 and 50 names and will have a maximum 8% allocation to individual holdings.

It is “particularly relevant in today’s market, where volatility and structural change require more than just passive exposure,” the firm said.

Chris Metcalfe, managing director at IBOSS, part of Kingswood Group, said: “Market conditions have changed significantly in recent years. The era of ultra-low interest rates and momentum-led markets has given way to a much more nuanced environment – one that demands active input, but also careful cost control.

“We’ve created the Blended MPS to reflect exactly that. It offers advisers a middle ground: a well-diversified, cost-effective solution that retains the active oversight clients increasingly need in a fast-moving world.”

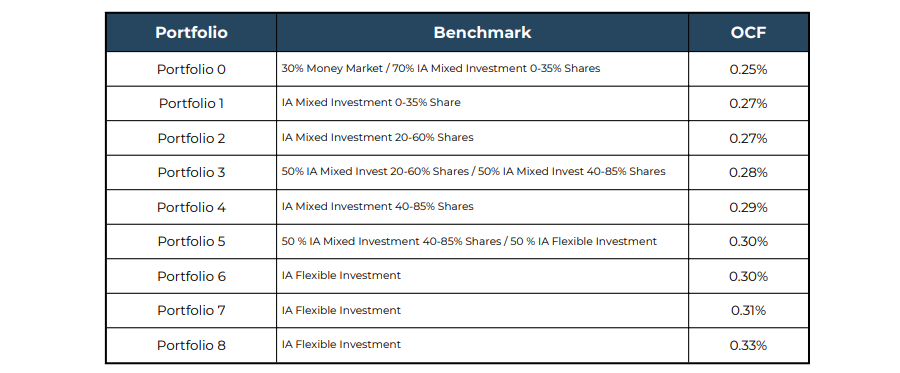

The new IBOSS Blended range

Source: IBOSS

Important legal information

Lloyds and Lloyds Bank are trading names of Halifax Share Dealing Limited. The Lloyds Bank Direct Investments Service is operated by Halifax Share Dealing Limited. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Registered in England and Wales no. 3195646. Halifax Share Dealing Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2025 Refinitiv, an LSEG business. All rights reserved.