‘75% of the top companies in India are uninvestable to us’, says Alpha Manager

Douglas Ledingham explains why his emphasis on capital preservation has caused them to stray from the benchmark.

- Patrick Sanders

- 5 min reading time

Source: Trustnet

Investors need to go beyond the benchmark to find the most attractive opportunities in Asian markets, according to Douglas Ledingham, co-manager of the Pacific Assets Trusts.

He pointed to India as a great example. Despite being 15% overweight to India compared to the MSCI AC Asia ex Japan index, the FE fundinfo Alpha Manager explained that “about 75% of the top companies in India are uninvestable to us”.

However, the region is still full of opportunities for investors who are willing to be a bit more adventurous and go beyond the benchmark, he said.

“It [India] is still where the greatest opportunities for us to hand our precious capital to world-class stewards, with top franchises well-positioned for long-term growth”, Ledingham explained.

Below, the Alpha Manager also explains why capital preservation is more important than chasing total returns and why tariff uncertainty is planting the “seeds for future growth”.

What is the philosophy of the Pacific Assets Trust?

We focus on the long-term stewardship of investors' capital. The foundation of how we think and act is that the biggest risk of investing is the possibility of losing money entirely, rather than deviating from the benchmark.

As a result, we want Pacific Assets Trust to look and behave substantially different from the index, by handing our investors capital to businesses that we are sure we can trust over a 10-year time horizon.

As part of this, we also want to hand capital over to companies with good sustainability positioning, so that we trust what they are doing.

What differentiates the trust?

We want to walk the talk with our focus on risk, so we have a high active share and try to avoid starting with the benchmark.

While there are plenty of ways to ‘climb the investing mountain’, capital preservation is still absolutely core. If you lose 50%, you have to climb another 100% before you start growing your investors' capital again. That is what we always tell ourselves.

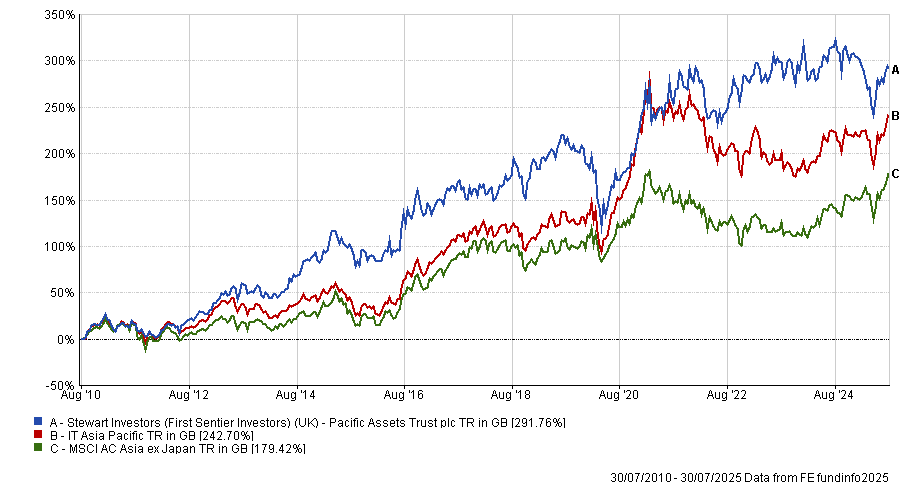

Since Stewart Investors took over the strategy in July 2010, we’ve performed well, which is a function of focusing on capital preservation during times of stress while generating attractive returns on the upside.

Performance of fund since team's start

Source: FE Analytics

Why have you been underweight China for so long?

If the portfolio’s defining characteristic is an overweight to India, the other main characteristic is an underweight to China.

It is difficult to find many Chinese companies we’re comfortable investing in, partly because so many are state-owned. In terms of valuations, while the index is cheap in terms of price-to-earnings, sectors and businesses we’ve been interested in have been too expensive, so we’ve been comfortable waiting on the sidelines.

We also value financial history. So when the stock market first opened to international investors, we did not understand how many companies had performed in both good and bad times, making investment difficult to justify.

However, as we’ve spent more time in China, we’ve become a lot more comfortable with a select group of companies, so the interest is rising.

What is your best holding in recent years?

Mahindra & Mahindra is an Indian conglomerate that we’ve owned for about 10 years. Since we increased it to one of our largest holdings in 2020, it has performed well.

The business is family-owned and while we have a lot of respect for the board's 80-year track record, we also had multiple discussions about their capital allocation decisions.

We got excited when the new chief executive officer was appointed in 2020, because we felt they had the opportunity to simplify the business and initiate some subtle shifts in strategy. Over the past five years, the share price is up by more than 400%.

And your worst?

Probably the biggest was a Japanese company we owned called Unicharm. Although it’s listed in Japan, it’s one of Asia’s leading personal hygiene companies.

It’s a wonderful company with wonderful brands, but we missed the change in Chinese consumers' mindset on global brands. Post pandemic, we’ve seen an incredible rise of domestic brands in China and the competitive landscape arguably became a bit too intense for Unicharm. That was frustrating.

Over the past year, it’s down more than 30%.

Are concerns over Donald Trump and tariffs impacting your opportunities?

This uncertainty is creating two types of opportunities. In the short term, good quality companies are getting sold off on the back of every news point that you can take advantage of.

Secondly, I think these environments of extreme uncertainty are where companies can prove they have a different perspective. Some businesses will be able to prove they have the ability and resilience to focus on customers and employees rather than shareholders.

When you’re in a situation where we’re all trying to guess what Donald Trump does next, I think companies that can hold customers' hands and solve their problems will generate a lot of loyalty. That will plant the seed of their future success.

What do you do outside of fund management?

I enjoy long runs in the hills outside Edinburgh with my brother, so endurance running and ultra-marathons. I think there’s probably a fair amount of overlap between the discipline and mental stress of running long distances and investing, which is probably why I like it so much. There is also a sense of escapism in it.

Important legal information

Lloyds and Lloyds Bank are trading names of Halifax Share Dealing Limited. The Lloyds Bank Direct Investments Service is operated by Halifax Share Dealing Limited. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Registered in England and Wales no. 3195646. Halifax Share Dealing Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2025 Refinitiv, an LSEG business. All rights reserved.