Fund managers get bullish as trade threat recedes, Bank of America survey shows

The closely watched survey shows cash allocations remain low while investors are overweight equities.

- Jonathan Jones

- 4 min reading time

Source: Trustnet

Fund managers are at their most optimistic since February, according to the latest survey from Bank of America.

There were several metrics used to calculate this. First, the survey found just 5% of asset allocators believed in the possibility of a hard landing – when an economy rapidly shifts from growth to flat as it approaches a recession, usually caused by government attempts to slow down inflation through raising interest rates.

Indeed, this week the Bank of England opted to lower rates, following on from the same decision by the European Central Bank last month, although the Federal Reserve stood pat last month despite president Donald Trump’s wishes to slash rates to as low as 1%.

Some 68% of respondents now predict a soft landing, versus 22% believing a no landing, while just 5% are positioned for a hard landing.

Expectations for global growth remain tepid (net 41% of respondents expected a weakening global economy over the next 12 months, up from 31% in July) but US rate cut optimism is at its highest since December 2024, the report found.

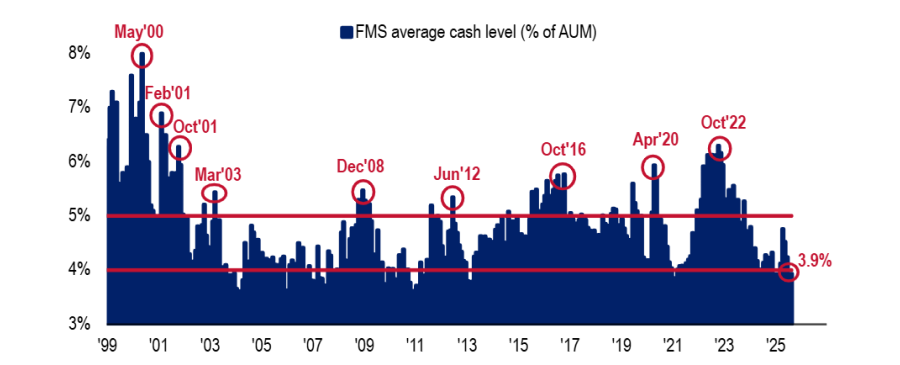

As such, the survey, which polled 197 managers with $475bn in assets under management between 31 July and 7 August, found cash levels have remained at a low of 3.9%. This is the same level as July, when it dropped from 4.2% the previous month.

BofA Global FMS cash level

Source: BofA Global Fund Manager Survey

The third metric was equity allocations, which ticked higher in August for the fourth consecutive month to a net 14% overweight compared with 4% in July – the highest level since February.

Investors moved more towards emerging markets, which has become the largest net overweight position among those surveyed. At a net 37% overweight, it is the highest level since February 2023. Yet emerging market stocks remain the most undervalued of all major trades, according to those surveyed with a net 49% stating the market is cheap (the most since February 2024).

Despite a net reduction in allocation to European stocks, it remains the second largest net overweight position.

Respondents are net 16% underweight the US, with a net 91% stating the American market is overvalued, a record for the survey and up from 87% in July.

At a sector level, investors rotated to utilities, energy and financials from healthcare, with investors now holding their lowest net overweight to the sector since February 2018.

Combining cash levels, equity allocations and global growth expectations, Bank of America's sentiment indicator rose to 4.5 from 4.3 the previous month, also its highest since February.

Investor sentiment rises to six-month high

Source: BofA Global Fund Manager Survey

However, there are risks. A trade war-led recession remains the biggest risk to investors, according to 29% of those surveyed, although this is down from 38% last month after countries made deals with the US in recent weeks, including Japan and the EU.

Elsewhere, 27% said inflation preventing the Fed from cutting rates was the market's biggest tail risk, 20% said it was a rise in bond yields and 14% highlighted an artificial intelligence (AI) equity bubble. All were significantly higher than the previous month.

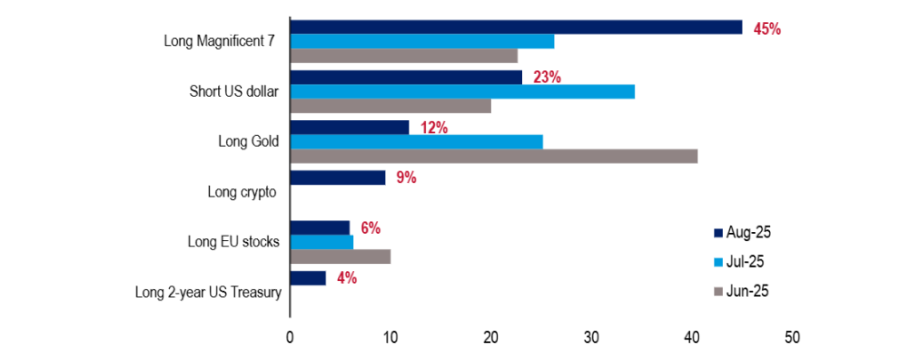

Being long the Magnificent Seven stocks (Amazon, Alphabet, Apple, Microsoft, Nvidia, Tesla and Meta) is the most crowded trade, according to 45% of investors, although a net 52% of respondents said they did not believe there would be an AI bubble.

What is currently the most crowded trade?

Source: BofA Global Fund Manager Survey

It is the first time since March that the tech giants have been viewed as the most crowded trade, taking the mantle from shorting the US dollar (23%), which held the top spot last month, and long gold (which held the spot between March and May).

Being long gold, cryptocurrencies, European stocks and two-year US treasuries were also named as overly popular allocations.

Although the gold trade is viewed as crowded, a net 41% of those surveyed said their allocation to the yellow metal was close to 0%, with the weighted average stake among those questioned at 2.2%, rising to 4.1% among those who are allocated to the metal.

Important legal information

Lloyds and Lloyds Bank are trading names of Halifax Share Dealing Limited. The Lloyds Bank Direct Investments Service is operated by Halifax Share Dealing Limited. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Registered in England and Wales no. 3195646. Halifax Share Dealing Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2025 Refinitiv, an LSEG business. All rights reserved.