Fund managers pile into tech stocks despite record overvaluation fears

The latest Bank of America positioning survey shows fund managers are at their most bullish since the start of the year.

- Gary Jackson

- 2 min reading time

Source: Trustnet

Fund managers have taken their overweight towards global equities to a seven-month high, a closely watched report shows, even though a record number believe the asset class is overvalued.

The latest edition of the Bank of America Global Fund Manager Survey polled 165 asset allocators running a total of $426bn between 5 and 11 Sep and found that sentiment is currently at its highest since February this year.

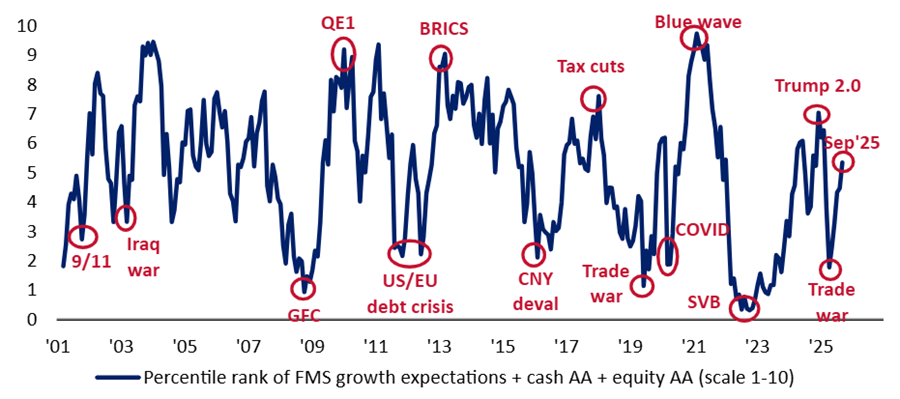

The survey’s broadest fund manager sentiment indicator – which examines professional investors’ cash levels, equity allocations and global growth expectations – rose from 4.5 in August to 5.4 in September.

Percentile rank of growth expectations, cash level and equity allocation

Source: Bank of America Global Fund Manager Survey – Sep 2025

As part of this, the net percentage of fund managers who are overweight equities has jumped to 28% this month. This is a 14 percentage point increase on last month.

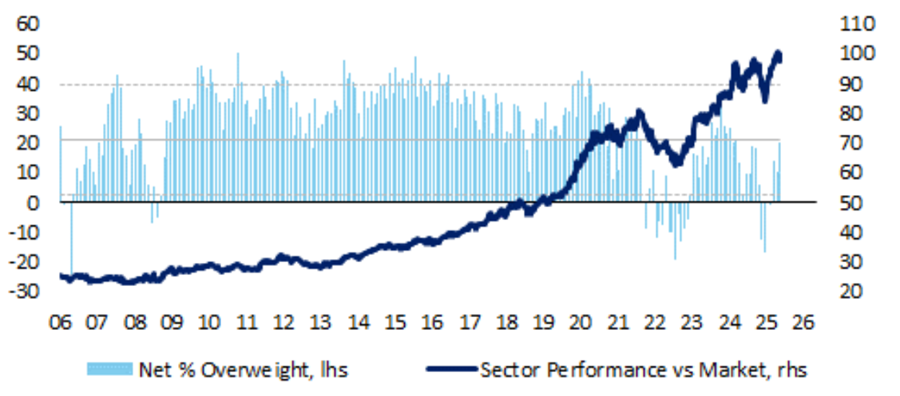

In addition, investors have a net 20% overweight to tech stocks. This is a 10 percentage point increase on August and takes the tech allocation to its highest level since July 2024.

Net % of fund managers overweight tech stocks

Source: Bank of America Global Fund Manager Survey – Sep 2025

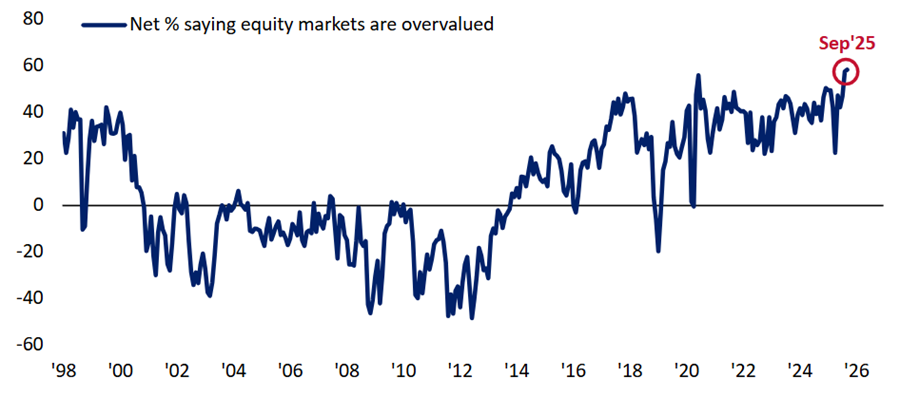

However, this comes at a time when fund managers are concerned about valuations in global stock markets, which have been driven higher in large part by tech stocks.

The report said: “A record 58% of [Fund Manager Survey] investors view global equity markets as overvalued, up slightly from 57% in August.

“Meanwhile just 10% of investors say bond markets are overvalued.”

Net % fund managers saying global equity markets are overvalued

Source: Bank of America Global Fund Manager Survey – Sep 2025

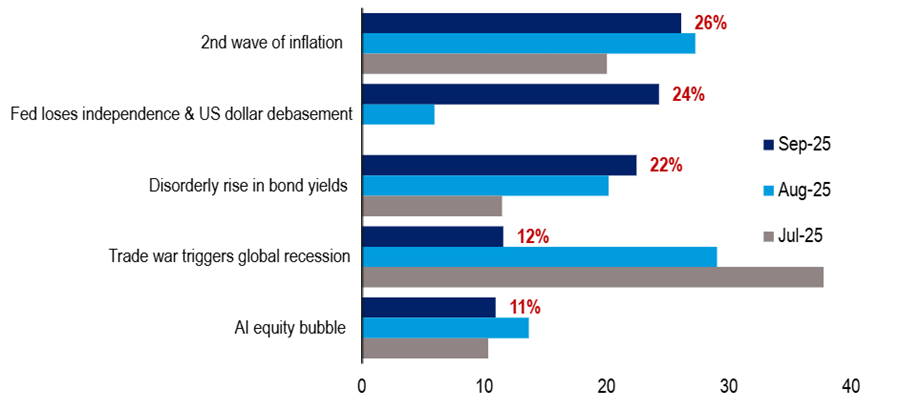

But overvaluation did not make it in the top market tail risks that fund managers are worried about this month.

The survey found 26% of respondents see a second wave of inflation as the most significant tail risk. A further 24% point to a loss of central bank independence and potential US dollar debasement as their primary concern.

Fears over trade-related risks appear to be diminishing. Only 12% of investors now view a trade war triggering a global recession as the biggest tail risk. This marks a sharp decline from August, when it ranked as the top concern for 29% of respondents.

Fund managers’ biggest tail risks

Source: Bank of America Global Fund Manager Survey – Sep 2025

Important legal information

Lloyds and Lloyds Bank are trading names of Halifax Share Dealing Limited. The Lloyds Bank Direct Investments Service is operated by Halifax Share Dealing Limited. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Registered in England and Wales no. 3195646. Halifax Share Dealing Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2025 Refinitiv, an LSEG business. All rights reserved.