The expensive European funds that have justified the costs

Trustnet examines the high-cost European portfolios with top-quartile returns.

- Patrick Sanders

- 4 min reading time

Source: Trustnet

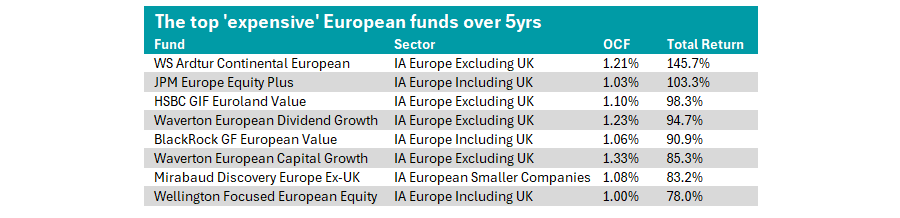

Over the past five years, eight European funds have delivered peer-beating performance despite high costs, according to data from FE Analytics.

The past half a decade has been a volatile time for European equities, as geopolitical conflict has built to a fever pitch, highlighted by the war between Russia and Ukraine.

Cheap low-cost passives were generally a better choice for navigating this uncertainty, research earlier this year found, but there are still a handful of active funds delivering bang for investors' buck.

In our ongoing series, we examined the funds in major markets with ongoing charges figure (OCF) above 1% that posted top-quartile returns.

Source: FE Analytics. Return in sterling to the end of August.

First on the list is the WS Ardtur Continental European fund, led by Oliver Kelton. The portfolio is an all-cap European equity approach, with Kelton meeting management teams around 500 times a year to identify opportunities.

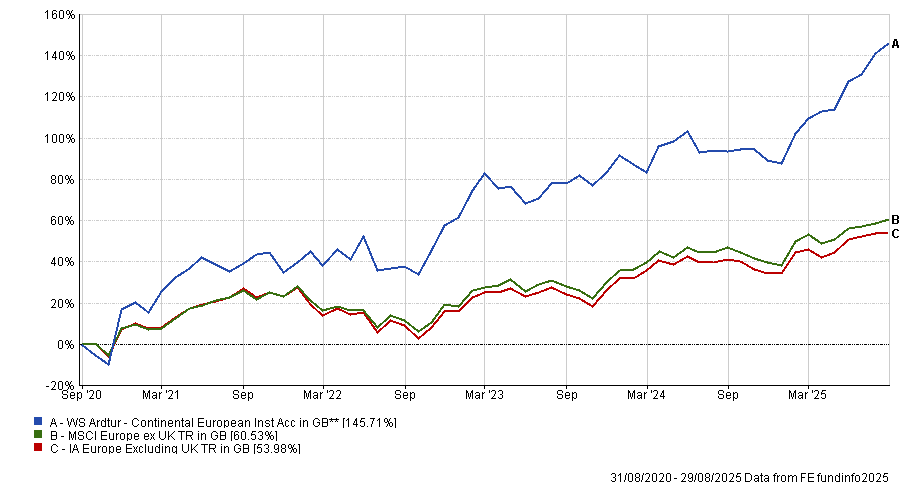

It is the second-best performing strategy in the IA Europe excluding UK sector over the past five years, pairing a 145.7% return with a 1.21% OCF.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics. Returns in Sterling to the end of August.

However, in 2024, the fund underperformed, falling into the bottom quartile of the sector. In its recent annual report, Kelton attributed this to declining investor sentiment towards Europe, as it navigated macroeconomic challenges while markets such as the US posted strong returns.

“When fears abound over political risks, structural challenges or sovereign debts, it is easy to comprehend the ‘why bother’ mentality that has pushed sentiment on European equities down to levels last seen in the eurozone crisis,” he said in the report.

However, the fund has rallied so far this year and is up more than 30%, as this trend reversed and investors began to pivot out of the US.

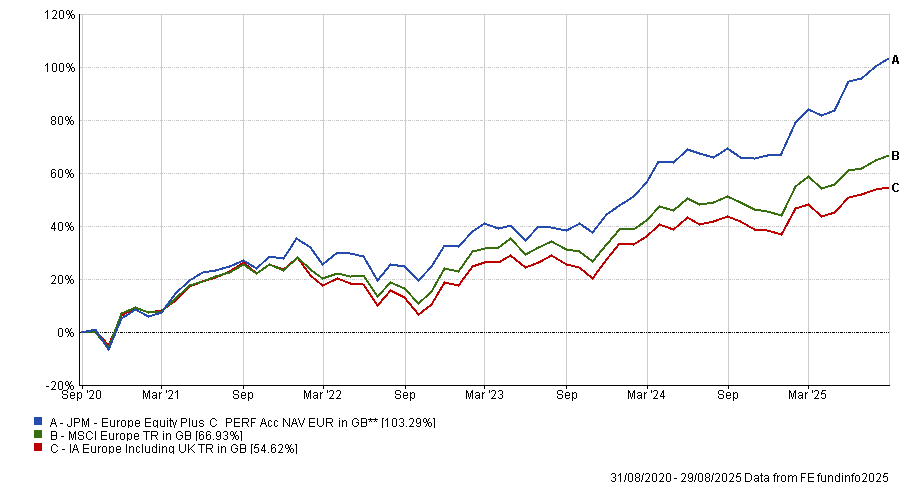

Next on the list is the £2.9bn JPM Europe Equity Plus (the largest strategy on the table), run by Michael Barakos, Nicholas Horne and FE fundinfo Alpha Manager Ben Stapley.

It is a long/short equity strategy, with the capacity to have around 30% of the portfolio in short positions against some of the “less attractive securities” on the market.

Meanwhile, at least 50% of the long book needs to be in companies with “positive ESG [environmental, social and governance] characteristics”.

Over the past five years, it is up 103.3%, one of the best performances in the IA Europe including UK sector, justifying its 1.03% OCF.

Performance of the fund vs sector and benchmark over 5yrs

Source: FE Analytics. Return in sterling to the end of August.

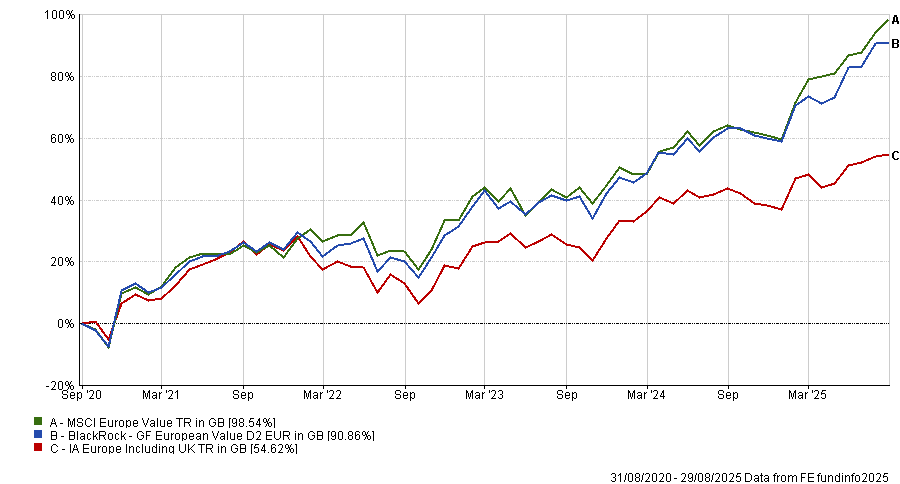

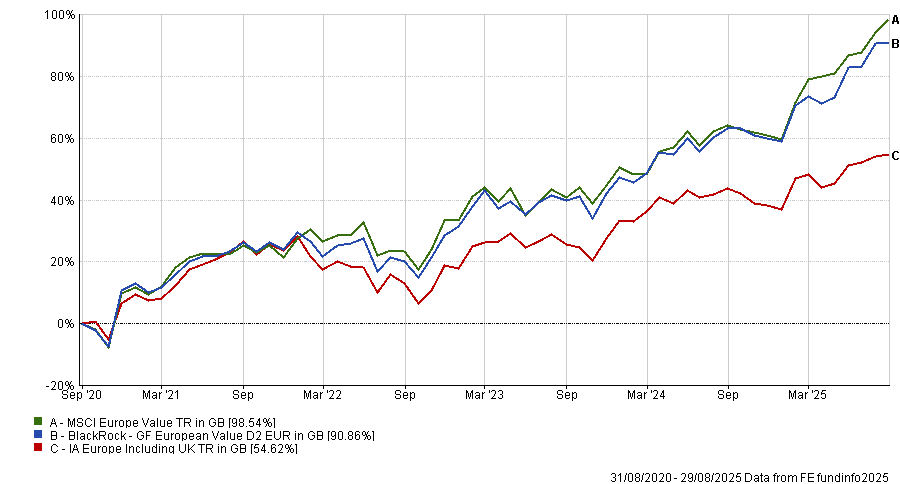

The second-largest portfolio on the list is the £1.1bn BlackRock GF European Value Fund, which balanced a 1.23% cost with a 90.9% return in the IA Europe including UK sector. Led by Brian Hall and Peter Hopkins, the fund emphasises companies that are undervalued.

It has a very different composition to the MSCI Europe Value index benchmark, with a 36% allocation to industrials (compared to 7% for the index).

Industrials such as Siemens, TotalEnergies, and Saint-Gobain feature in the top 10 and all have benefited from their share prices surging in the past five years.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics. Return in sterling to the end of August.

One smaller company mandate also made the list, the £115m Mirabaud Discovery Europe ex-UK fund, led by Hywel Franklin and Trevor Fitzgerald. It paired a 1.08% cost with an 83.2% five-year performance, the third-best return in the IA European Smaller Companies peer group.

The fund targets small-cap and mid-cap companies, with characteristics such as “niche market dominance, transformational change and innovation leadership”.

The managers believe that, due to lower analyst coverage, there is much less efficiency in small-cap and mid-cap markets, enabling the team to find “hidden gems”.

“Our process continues to discover smarter, safer and circular businesses across continental Europe that are well positioned for the future. We continue to see opportunities in consumer, technology and financial businesses,” the managers said in the latest monthly factsheet.

For example, the managers explained that they added to Suess Microtec in August, a manufacturer of semiconductor materials that was one of their top contributors in 2024.

This approach has broadly paid off for the fund in recent years, with further top-quartile returns in the past three and one years.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics. Return in sterling to the end of August.

Two strategies from the Waverton team appeared on the list: Waverton European Dividend Growth (up 94.7%) and Waverton European Capital Growth (up 85.3%). Rounding out the shortlist are the HSBC GIF Euroland Value fund and the Wellington Focussed European Equity fund.

Previously in this series, we have examined the Global, US and UK markets.

Important legal information

Lloyds and Lloyds Bank are trading names of Halifax Share Dealing Limited. The Lloyds Bank Direct Investments Service is operated by Halifax Share Dealing Limited. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Registered in England and Wales no. 3195646. Halifax Share Dealing Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2025 Refinitiv, an LSEG business. All rights reserved.