Why now for the emerging markets

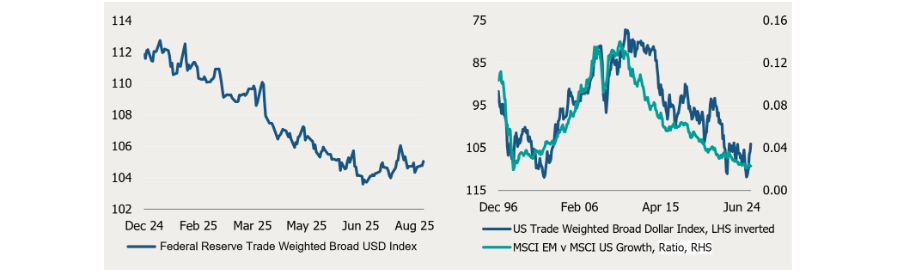

Periods of dollar weakness have historically delivered the strongest returns for emerging markets.

- Ada Chan

- 3 min reading time

Source: Trustnet

Periods of dollar weakness have historically delivered the strongest returns for emerging markets. That pattern may be repeating today as the dollar softens and conditions improve across many emerging economies.

Inflation is easing, interest rates remain relatively high, and central banks have room to support growth.

At the same time, emerging market (EM) equities are still trading at a clear discount to developed market levels, offering investors both return potential and enhanced portfolio diversification at a meaningful discount.

Why dollar weakness matters

Over the past three decades, periods of EM equity outperformance have coincided with dollar weakness. When capital shifts from the US into global markets, emerging economies typically experience stronger currencies, lower import costs, and easier financial conditions.

This combination has historically provided a powerful lift to both domestic growth and asset prices in EM economies. Although global trade policy remains unsettled, activity has held up, and today’s backdrop resembles prior supportive periods.

In this stage of the dollar cycle, emerging markets offer a rare combination of cyclical upside, structural diversification, and attractive entry valuations.

Source: JOHCM

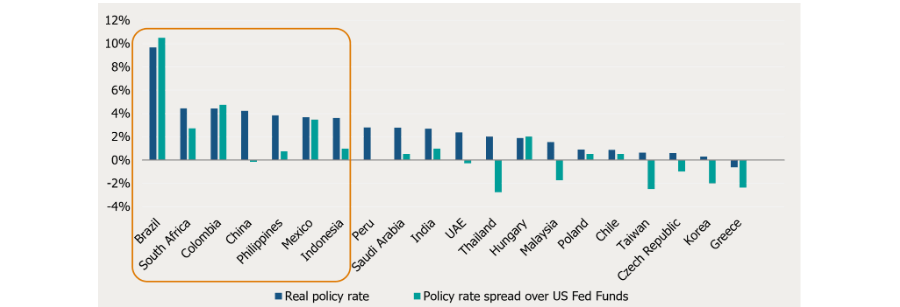

Where opportunity lies

Emerging markets today can be grouped by their structural positioning:

- Deep market countries

Taiwan, Korea, Hong Kong, and the UAE benefit from well-developed financial markets. Their currencies have strengthened as the dollar has fallen, although reliance on exports may make further gains harder to sustain in the short term.

- Dollar-anchored economies

Saudi Arabia, Thailand, and Malaysia hold substantial dollar savings but their exchange rates are strictly managed against the dollar. As a result, their prospects depend more on external moves in the dollar than on domestic policy.

- Borrower nations

Brazil, Mexico, Indonesia, and India are best placed to benefit from this phase of the cycle. In these countries, stronger currencies and lower inflation allow central banks to cut rates, creating a backdrop that is typically favourable for equities.

- China

China sits outside these Categories. Its currency is tightly managed, reducing sensitivity to external dynamics. The outlook there will depend on the scale of stimulus chosen by policymakers.

Source: JOHCM

The case for investors

Economic growth in emerging markets has been substantially faster than in developed markets over the past 10 years, yet equity market returns have lagged. That is consistent with a historical pattern of cyclicality in returns from the emerging market equity asset class.

Periods of dollar weakness have historically delivered the strongest returns for emerging markets. That pattern may be repeating today as the dollar weakens and conditions improve across many EM economies.

Emerging markets remain overlooked, with EM equities still trading at a clear discount to developed market levels, offering investors both return potential and enhanced portfolio diversification at a meaningful discount.

Ada Chan is the senior fund manager of JOHCM Global Emerging Markets Opportunities. The views expressed above should not be taken as investment advice.

Important legal information

Lloyds and Lloyds Bank are trading names of Halifax Share Dealing Limited. The Lloyds Bank Direct Investments Service is operated by Halifax Share Dealing Limited. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Registered in England and Wales no. 3195646. Halifax Share Dealing Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2025 Refinitiv, an LSEG business. All rights reserved.