Source: Sharecast

For the three months ended 30 September, revenue climbed 26% year-on-year to $11.3bn on an adjusted basis, well ahead of Wall Street forecasts, while adjusted earnings per share rose 44% to $1.66.

Free cash flow increased 30% to $2.4bn, and operating profit advanced 26% to $2.3bn, maintaining a margin of about 20%.

On a GAAP basis, total revenue reached $12.2bn and profit $2.5bn, with earnings per share of $2.04.

Culp said the strong results reflected the company’s “customer-driven approach to continuous improvement” through its lean ‘Flight Deck’ operating system.

“We are seeing that materialise this quarter with strong services and engine output for our customers,” he said.

The company, he added, was “raising full-year guidance across the board” after delivering more than 130% free-cash-flow conversion.

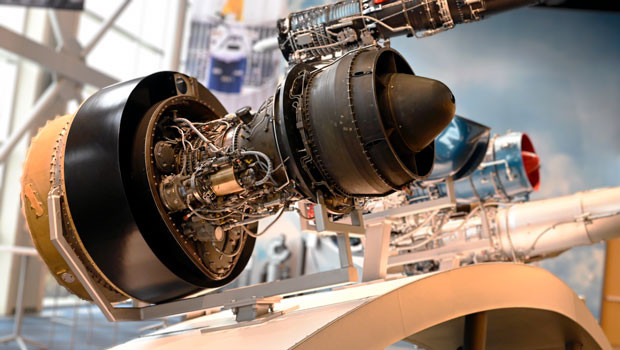

Commercial engines and services revenue grew 28% on the back of record engine deliveries, which rose 33% overall and 40% for the LEAP narrowbody engine line.

Defence deliveries surged 83%, as the segment’s profit rose 35% as a favourable mix of shop visits and spare-parts sales offset cost pressures.

GE Aerospace said it had increased material input from priority suppliers by 35% year-on-year as it worked to ease long-running bottlenecks.

The company reported fresh contract wins including Korean Air’s largest-ever order - 103 Boeing jets powered by GEnx, GE9X and LEAP-1B engines - and an agreement with Cathay Pacific for 28 additional GE9X units.

It also advanced testing on the GE9X and CFM RISE programmes to enhance engine durability and completed its first in-flight supersonic test campaign.

On the back of the performance, GE Aerospace said it now expected adjusted earnings per share of $6.00 to $6.20 for 2025, up from $5.60 to $5.80 previously, with operating profit of $8.65bn to $8.85bn and free cash flow of $7.1bn to $7.3bn.

Adjusted revenue growth was projected in the high-teens, supported by continued double-digit demand for commercial and defence propulsion systems.

Culp said the group’s focus on innovation and reliability - through programmes such as LEAP durability upgrades, open-fan architectures and hybrid-electric propulsion partnerships - would “help us build on this momentum and position us for growth”.

At 0916 EDT (1416 BST), shares in GE Aerospace were up 2.51% in premarket trading in New York, at $310.49.

Reporting by Josh White for Sharecast.com.