UK dividends drop 4.6% in 2025’s opening quarter

Despite the fall, payouts from UK businesses have been better than expected.

- Gary Jackson

- 4 min reading time

Source: Trustnet

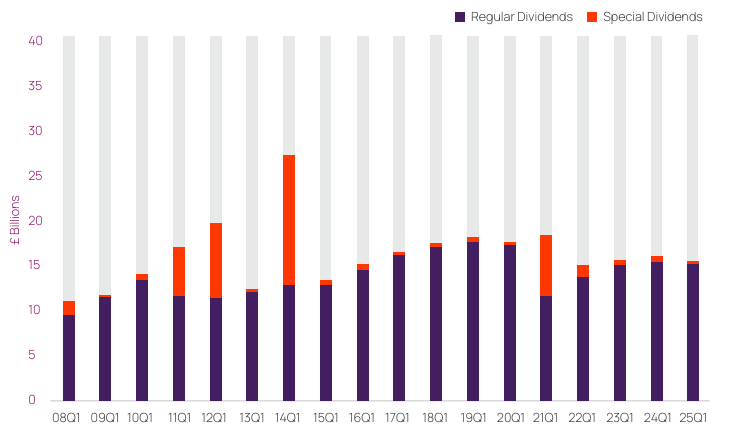

Dividends paid out by UK companies fell 4.6% in the first three months of 2025, according to Computershare’s latest Dividend Monitor, but still managed to beat expectations.

The headline total paid out to shareholders in 2025’s opening quarter amounted to £14bn, compared with £14.7bn in the same period of 2024.

The report added that while this decline “looks disappointing”, it is down to lower one-off special dividends and a few large cuts, rather than across-the-board weakness.

Underlying dividends – or regular payouts that exclude specials and adjusted for constant currency – totalled £13.6bn, down just 0.2% year-on-year.

Both the headline and underlying change were better than Computershare’s analysts had expected. The 0.2% fall in underlying dividends, for example, significantly outperformed expectations of a 2.7% drop.

UK Q1 dividends

Source: Computershare Dividend Monitor

Mark Cleland, chief executive of issuer services UK, Channel Islands, Ireland and Africa at Computershare, said: “Dividends are typically less likely than company profits to experience short-term fluctuations either during economic turbulence or in boom times, as most companies seek to deliver steady income growth over time for their investors.

“Nevertheless, any cooling driven by the current upheaval in financial markets and the real global economy is likely to affect profits, and this will subsequently knock on to dividend payouts.

“We are unlikely to see much effect on regular dividends in the next couple of quarters, but discretionary special dividends particularly have proven more vulnerable to economic difficulty historically.”

The first quarter’s “slightly better outcome” was the result of growth in payouts from the healthcare, food, industrials and leisure sectors.

Pharmaceutical companies were the biggest dividend payers over the three-month period, distributing £3.2bn – a year-on-year increase of £228m. AstraZeneca raised its dividend by 6.6% (after over a decade in which its dividend only increased once and by just 3.6%) while GSK’s dividend was up by 7.1% year-on-year.

AstraZeneca was the largest dividend payer in the first quarter, the fourth year in a row it has held this title.

However, there were also notable cuts during the quarter: Vodafone halved its payout to use cash for infrastructure investment, Burberry’s remained on hold after its profit warning last year and Bellway Homes lowered its dividend because of a weak housing market.

The first-quarter growth rate was reduced by five percentage points by these three companies alone.

Looking forward, the Computershare Dividend Monitor said the prospect for dividend payouts in the second quarter look positive after the better-than-expected results of the first quarter. It expects this to be led by banks and food retailers.

Computershare has upgraded its whole-of-2025 expectation for underlying growth to 1.8% on a constant currency basis. This is up from 1% three months ago and suggests £85.6bn in regular dividends over the year.

However, the headline dividend forecast was cut from 0.7% growth to zero because of the strengthening of the pound against the dollar. If this persists at its current level, headline growth will be eliminated altogether, with headline dividends of £90.1bn matching 2024’s.

Commenting on the report, Henderson High Income Trust portfolio manager David Smith said: “Although the headline dividend growth looks disappointing this was mainly due to lower one-off special dividends. These can be volatile and investors shouldn’t be too concerned given they are more discretionary than ordinary dividends.

“Certainly given the uncertain economic outlook caused by president Trump’s trade policies we would expect companies to take a more conservative approach and pare back special dividends and share buybacks to preserve cash flows.

“However, it’s important to remember that UK companies are in a healthy position with strong balance sheets while ordinary dividends are well covered by profits, much more so than at the start of the Covid pandemic. Hence, we believe ordinary dividends will be resilient going forward on an underlying basis.”

Important legal information

Lloyds and Lloyds Bank are trading names of Halifax Share Dealing Limited. The Lloyds Bank Direct Investments Service is operated by Halifax Share Dealing Limited. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Registered in England and Wales no. 3195646. Halifax Share Dealing Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2025 Refinitiv, an LSEG business. All rights reserved.