Europe, mid-caps and global equities: Four Aviva funds fail to offer value, finds report

The firm’s value assessment highlighted four funds worthy of a red flag.

- Jonathan Jones

- 4 min reading time

Source: Trustnet

Four of the 16 Aviva Investors funds featured in its latest value assessment have failed to provide value for investors, with poor recent performance heavily impacting medium-term returns.

The firm uses a traffic light system, with a green rating suggesting the board is satisfied that investors are getting value. Amber means there is room for improvement in some areas, but overall the fund is delivering value.

If the board is not satisfied that a fund is delivering value and thinks actions must be taken to address this, it is given a red rating.

Aviva Investors Continental European Equity, Aviva Investors Global Equity Endurance, Aviva Investors UK Listed Equity Unconstrained and Aviva Investors UK Listed Small and Mid-Cap were all given a red rating by the firm.

The largest of the four funds above is the £449m Global Equity Endurance strategy run by FE fundinfo Alpha Manager Richard Saldanha, Max Burns and Temi Oni Iyiola.

Formerly managed by Saldanha, Francois De Bruin and Matt Kirby, the trio left Aviva in 2024 to join Royal London, although Saldanha returned to Aviva after a month.

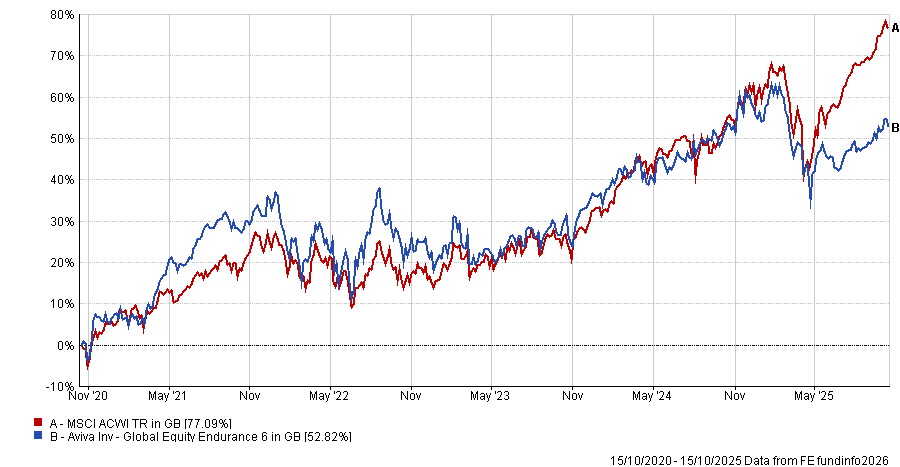

Its objective is to provide an average annual net return greater than the MSCI ACWI over a rolling five-year period. However, for the year ended 15 October 2025, it had underperformed the index by 16.2 percentage points, the report noted.

These past 12 months mean the portfolio is now 15.1 percentage points off its benchmark over five years, as the chart below shows.

Performance of fund vs benchmark over 5yrs

Source: FE Analytics

The report noted that underweights to industrials, consumer discretionary stocks, financials and healthcare stocks contributed to the poor performance.

Former Schroders manager and Lombard Odier head of global sustainable equities Nicholette MacDonald-Brown was brought in as global head of active equities in November, with the report noting that she is “focused on enhancing the investment process as a top priority”.

As a result, there will be no further changes to the fund at this time, it noted.

Charlotte Meyrick and Mathew Bennison are responsible for the two UK funds above found not to be providing value to investors.

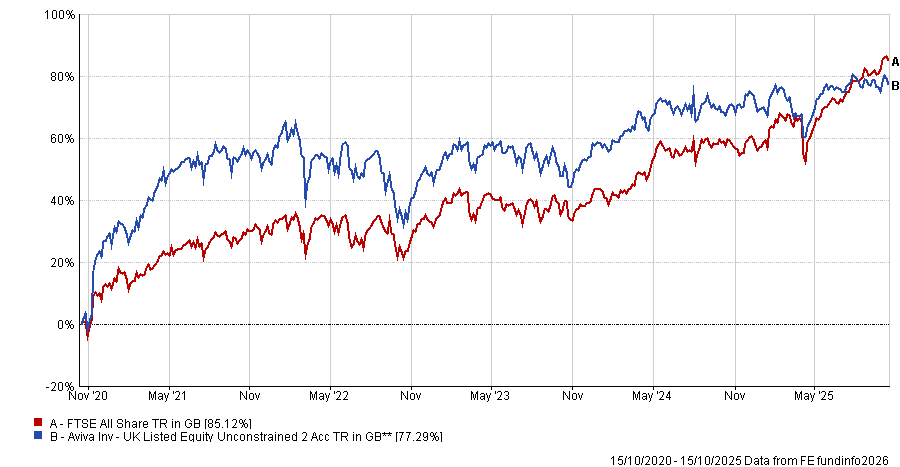

Meyrick has run the £172m UK Listed Equity Unconstrained fund since 2024, which has failed to meet its objective to beat the FTSE All Share over rolling five-year periods. For the half-decade to 15 October 2025, it was 1.2 percentage points short of this goal.

Like the global fund above, a disappointing 12 months hampered its medium-term returns. The fund lagged the index by 12.2 percentage points over this time.

Bennison was brought into the firm as head of UK equities in 2026 and was added as co-manager to the fund.

Also formerly at Schroders, he was appointed at the same time as MacDonald-Brown.

His “priority has been to review performance concerns, identify underlying issues and implement improvements to the investment process”, the report noted.

“The board views the recent changes to the investment management team as positive enhancements to the investment capability, which will improve performance over the long term. The board do not therefore propose to take any further action at this stage,” the report read.

The exact same wording was used on the pair’s other fund, the £154m UK Listed Small and Mid-Cap fund. Meyrick has run this portfolio since 2016, with Bennison joining at the start of this year.

Aviva Investors UK Listed Small and Mid-Cap has underperformed the FTSE 250 Excluding Investment Trusts benchmark by 3.5 percentage points over the five years to 15 October 2025 after a poor 12 months.

Performance of fund vs benchmark over 5yrs

Source: FE Analytics

Lastly, Alpha Manager Matthew Barrett’s £125m Aviva Investors Continental European Equity fund was also given a red flag by the asset management firm.

It has underperformed the Europe ex UK index over five years by 5.1 percentage points. In the prior 12 months, it lagged the benchmark by some 13 percentage points.

“The fund’s performance over the year was affected by market conditions that favoured lower quality, more cyclical and domestically focused European companies,” the report noted.

“This differed from the fund’s long-term investment approach, which focuses on investing in higher-quality companies that are expected to grow steadily over time.”

Barrett took charge of the fund in 2022, meaning not all of the period above can be ascribed to the current manager. The report said the three years he has helmed the fund “represents a relatively limited timeframe” to assess.

However, it noted the board would keep the fund’s performance “under enhanced review”.

Aviva Investors' latest value assessment looked at the 16 investment company with variable capital (ICVC) funds. In total, the asset manager runs 91 funds. Value assessments for other fund structures will be released later in the year.

Important legal information

Lloyds and Lloyds Bank are trading names of Halifax Share Dealing Limited. The Lloyds Bank Direct Investments Service is operated by Halifax Share Dealing Limited. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Registered in England and Wales no. 3195646. Halifax Share Dealing Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2026 Refinitiv, an LSEG business. All rights reserved.