AI-washing: Companies are rebadging tech as AI for ‘fear of losing their premium rating’

Rathbones managers James Thomson and David Harrison explain why companies must show AI use cases to “get out of the way of the steam train” of being branded an AI loser.

- Jonathan Jones

- 4 min reading time

Source: Trustnet

Companies could be ‘AI-washing’ by rebadging old technology as artificial intelligence (AI) to stave off investors who are hunting out and selling the perceived losers from the fast-evolving AI landscape.

James Thomson, manager of the £3.6bn Rathbone Global Opportunities Fund, said normally markets embrace a “fairly broad church of different types of companies” but over the past few years returns have been myopically focused on AI “to the exclusion of almost every other kind of investment theme in the market”.

“[There has been a] hyperactive singular focus around AI and a total disinterest in everything else, creating this red hot, ice cold market,” he said.

This has put pressure on companies to adapt to an AI-future, whether by creating the technology themselves or integrating it into their business models.

A “halo effect” has now surrounded companies using the new technology, leading to some “trying to put on the AI cloak” to protect their share prices.

“If you don’t have an AI angle to your investment case at the moment, your multiple is getting slammed,” he said.

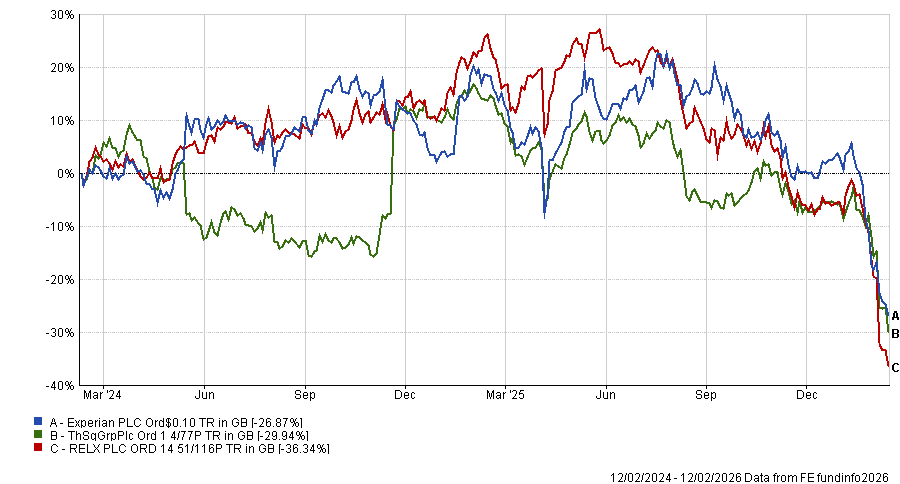

Thomson pointed to the UK, where information services businesses such as Relx, Experian and Sage have all suffered in recent weeks, as the below chart shows.

Performance of stocks over 2yrs

Source: FE Analytics

“We’re seeing one of the biggest dislocations I’ve ever seen in the market, which is this belief that ‘software is dead’ and that AI will replace it,” said the Rathbone Global Opportunities Fund manager. “At the moment, it's a fiction – but it's a fiction that is guilty until proven innocent.”

This has created a lot of “panic”, with companies “just trying to get out of the way of this steam train of potential AI losers”.

“It’s causing a lot of active managers to run around with their hair on fire, because the AI losers are overweight positions for a lot of the active fund‑management industry,” he said.

His colleague David Harrison mentioned several companies he likes that are using AI in their business models last week, but admitted that more than 50% of AI use cases in the market are merely “rebadging” older technology.

An example is toothpaste brand Colgate-Palmolive, which has developed a pricing tool using AI inputs to adjust to market dynamics more quickly. While this approach is technically new, the company is “rebadging” technology that previously existed.

“When you’re pricing toothpaste, what can you do? All it’s doing is using a dataset and managing it a bit better,” he said.

But Colgate-Palmolive is far from alone in doing this. “I would say less than 50% [of AI usage] is genuinely new and not an efficiency tool. The net effect on margins and benefits you get economically is still there, but [investors should be] careful of rebadging,” he said.

Thomson explained that companies have to convince investors they are the future by embracing the technology or risk being put into the ‘AI losers’ bucket.

“I think there is an arms race to adopt AI, simply out of fear of being put into the wrong camp, losing the narrative and losing your premium multiple,” he said.

He added that it is difficult to spot the difference between machine learning – a technology that has been around for a long time – and AI.

One company he believes is using AI is Walmart, the American supermarket chain. It has created two AI agents – one called Wally and the other called Marti.

Third-party sellers use Marti to put their products on Walmart.com, he said, streamlining a formerly “long-winded” process.

“All of the product details, the descriptions and all the back‑and‑forth between the logistics teams and the data availability about how long it will take to ship has to be in place before you can even put the product on the site. The AI agent Marti significantly reduces the amount of time to get new products onto the site,” he said.

It's hard to know whether this will prove significantly beneficial to profits, Thomson noted. Yet Walmart management “certainly are talking about it and the market is clearly buying into it because it maintains its premium multiple”.

Important legal information

Lloyds and Lloyds Bank are trading names of Halifax Share Dealing Limited. The Lloyds Bank Direct Investments Service is operated by Halifax Share Dealing Limited. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Registered in England and Wales no. 3195646. Halifax Share Dealing Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

The information contained within this website is provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd unless otherwise stated. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. This is a solution powered by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd incorporating their prices, data news, charts, fundamentals and investor tools on this site. Terms and conditions apply. Prices and trades are provided by Allfunds Digital, S.L.U. acting through its business division Digital Look Ltd and are delayed by at least 15 minutes.

Data provided by FE fundinfo. Care has been taken to ensure that the information is correct, but FE fundinfo neither warrants, represents nor guarantees the contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance does not predict future performance, it should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise.

© 2026 Refinitiv, an LSEG business. All rights reserved.